Trivia Tuesday Series

The Slayer Rule prohibits murderers from retaining an interest in their victim’s estate.

Answer: TRUE

To learn more, click here for more information: https://www.law.cornell.edu/wex/slayer_rule

The United States’ tax burden is ________ compared to other advanced economies.

Answer: Lower

To learn more, reference the image below and click here: https://www.pgpf.org/chart-archive/0055_tax-burdens-international

Works in the Public Domain can be used without a violation of copyright.

Answer: True

For more information, click here: https://fairuse.stanford.edu/overview/public-domain/welcome/

Coca-Cola’s syrup was invented by a man of which profession?

Answer: Pharmacist

To learn more, click here: https://www.coca-colacompany.com/about-us/history/the-birth-of-a-refreshing-idea

How many U.S. Courts of Appeals are there?

Answer: 13

For more information, click here: https://www.uscourts.gov/about-federal-courts/court-role-and-structure

When was CMS (Centers for Medicare & Medicaid Services) created?

Answer: 1965

To learn more, click here: https://www.cms.gov/About-CMS/Agency-Information/History

In 2023, an Estate Tax Return is applied if the gross estate exceeds _____.

Answer: $12,920,000

For more information, click here: https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

The federal tax system in the United States is _____.

Answer: Progressive

To learn more, visit these sites:

https://www.pgpf.org/chart-archive/0102_tax-rates

https://taxfoundation.org/tax-basics/progressive-tax/

How long does a copyright last?

Answer: Life of Creator +70 years

For more information, visit this site:

https://www.copyright.gov/help/faq/faq-duration.html

Cotton candy was invented in Tennessee.

Answer: TRUE

To learn more, visit these sites:

https://patents.google.com/patent/US618428A/en

The statement explaining the right to an attorney that police must proclaim upon an arrest came out of which case?

Answer: Miranda V. Arizona

Visit this site to learn more: https://www.history.com/topics/united-states-constitution/miranda-rights

Which notorious criminal was arrested and convicted on tax evasion charges?

Answer: Al Capone

To learn more, visit this site: https://www.fbi.gov/history/famous-cases/al-capone

What working vehicle was invented in Tennessee?

Answer: Tow Trucks

Visit this site to learn more: https://www.timesfreepress.com/news/2016/oct/01/chattanoogas-holmes-family-invented-tow-truck/

You can copyright an idea.

Answer: FALSE

Visit this site for more information: https://www.copyright.gov/help/faq/faq-protect.html

Who was the first certified female attorney in the United States?

Answer: Arabella Mansfield (Iowa)

For more information about Arabella click here: https://iowaculture.gov/history/education/educator-resources/primary-source-sets/government-democracy-and-laws/arabella

What percentage of individual tax returns were filed electronically in 2022?

Answer: 90%

Click this link for more information: https://www.irs.gov/statistics/returns-filed-taxes-collected-and-refunds-issued

Which renowned museum was born out of the footnote of a will?

Answer: The Smithsonian Institution

Visit this site to learn more: https://www.history.com/this-day-in-history/smithsonian-institution-created

James C. Boyle invented a device that automatically saluted by tipping a man’s hat.

Answer: TRUE

Visit this site to learn more and view the invention’s blueprints: https://patents.google.com/patent/US556248A/en

What is the popular green drink that was invented in Tennessee?

Answer: Mountain Dew

Visit this site to learn more:

https://contact.pepsico.com/mtndew/article/when-was-mountain-dew-invented-how-did-it-get-its-name

TESS is an acronym for…

Answer: Trademark Electronic Search System

Visit this site to learn more:

https://www.uspto.gov/trademarks/search

To conduct your own search using the TESS, click here.

How much does it cost taxpayers for every $100 that is collected by the IRS?

Answer: 41 cents

Visit this site to learn more:

https://apps.irs.gov/app/understandingTaxes/student/whys_thm03_les01.jsp

Which President of the U.S. signed the Revenue Act of 1862 that created Federal Income Taxes?

Answer: Abraham Lincoln

Visit this site to learn more:

https://www.irs.gov/newsroom/historical-highlights-of-the-irs

Which category does the U.S. Government collect most of its revenue from?

Answer: Individual Income Taxes

Visit these sites to learn more:

https://www.pgpf.org/finding-solutions/understanding-the-budget/revenues

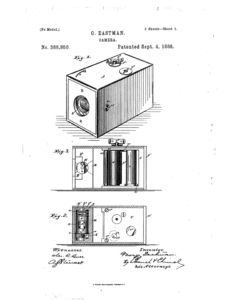

What was the first patented invention by George Eastman that was the foundation of the Eastman-Kodak business?

Answer: First practical roll form film camera

Visit these sites to learn more:

https://www.eastman.org/camera-obscura-revolutionary-kodak

National Museum of American History

Who was the first U.S. President to be a lawyer?

Answer: John Adams

Visit these sites to learn more:

https://www.whitehouse.gov/about-the-white-house/presidents/john-adams/

https://www.history.com/topics/us-presidents/john-adams

As of 7/5/22 we have switched Trivia Thursday posts to Trivia Tuesday!

How many states have no income tax?

Answer: 9

Visit these sites to learn more:

https://www.forbes.com/advisor/taxes/states-with-no-income-tax/

https://www.cnbc.com/select/states-with-no-income-tax/

https://www.aarp.org/money/taxes/info-2020/states-without-an-income-tax/

In what year did the Supreme Court increase to the present total of nine Justices?

Answer: 1896

Visit this site to learn more:

https://www.supremecourt.gov/about/institution.aspx

You can get a trademark registered for a sound.

Answer: TRUE

Visit these sites to learn more:

https://tmep.uspto.gov/RDMS/TMEP/Oct2012#/Oct2012/TMEP-1200d1e2927.html

https://www.uspto.gov/trademarks/soundmarks/trademark-sound-mark-examples

What year was the American Bar Association founded?

Answer: C! 1878

See the full American Bar Association timeline of events here:

https://www.americanbar.org/about_the_aba/timeline/

Who said that the Patent Laws “…added the fuel of interest to the fire of genius, in the discovery and production of new and useful things”?

Answer: Abraham Lincoln

Read his full speech here: http://www.abrahamlincolnonline.org/lincoln/speeches/discoveries.htm

Can you trademark a color?

Answer: YES

Some examples include: Tiffany blue, Caterpillar Inc. yellow, T-Mobile magenta, and Owens & Corning pink.

Visit this site to learn more:

https://tmep.uspto.gov/RDMS/TMEP/current#/current/TMEP-1200d1e1975.html

Intellectual Property includes…

Answer: All of the above

Visit this site to learn more:

https://www.wto.org/english/tratop_e/trips_e/intel1_e.htm

Tax Day has always in April.

Answer: FALSE

Originally, Congress set March 1st to be tax day with the passage of the 16th Amendment.

Visit this site to learn more:

https://guides.loc.gov/this-month-in-business-history/april/tax-day

Who was the U.S. President that nominated the most Justices to the U.S. Supreme court (excluding George Washington)?

Who was the U.S. President that nominated the most Justices to the U.S. Supreme court (excluding George Washington)?

Answer: Franklin D. Roosevelt

Visit these sites to learn more:

https://fdr.blogs.archives.gov/2016/02/23/fdr-and-the-supreme-court-a-lasting-legacy/

https://www.supremecourt.gov/about/institution.aspx

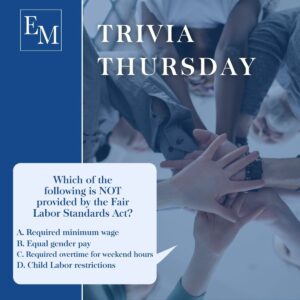

Which of the following is NOT provided by the Fair Labor Standards Act?

Answer: Required overtime for weekend hours

Visit this site to learn more:

https://www.dol.gov/agencies/whd/flsa

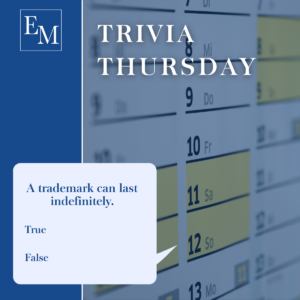

A trademark can last indefinitely.

Answer: TRUE

Visit this site to learn more:

https://www.uspto.gov/trademarks/maintain/keeping-your-registration-alive

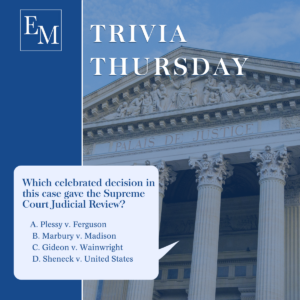

Which celebrated decision in this case gave the Supreme Court Judicial Review?

Answer: Marbury v. Madison

Visit these sites to learn more:

https://www.loc.gov/rr/program//bib/ourdocs/marbury

https://www.oyez.org/cases/1789-1850/5us137

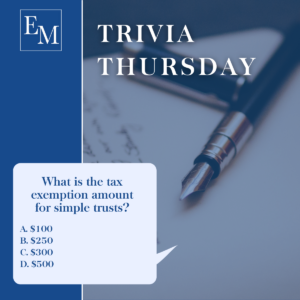

What is the tax exemption amount for simple trusts?

Answer: $300

Visit these sites to learn more:

https://www.law.cornell.edu/cfr/text/26/1.642(b)-1

https://www.irs.gov/pub/irs-utl/overview_of_fiduciary_income_taxation.pdf

Which of the following is the federal law which prohibits discrimination based upon age?

Which of the following is the federal law which prohibits discrimination based upon age?

Answer: Age Discrimination in Employment Act

Visit these sites to learn more:

https://www.eeoc.gov/statutes/age-discrimination-employment-act-1967

https://www.eeoc.gov/age-discrimination

What word did Alexander Hamilton misspell in the U.S. Constitution?

Answer: Pennsylvania

Visit these sites to learn more:

https://www.pennlive.com/opinion/2015/09/us_constitution_fun_facts.html

https://www.pbs.org/wgbh/americanexperience/features/duel-hamilton-and-us-constitution/

In TN, product liability actions from a physical injury must be brought within how many years?

Answer: 1 year

Visit this site to learn more:

https://www.enjuris.com/tennessee/defective-product-lawsuit

If defamation is oral, it is called ___.

Answer: Slander

Visit this site to learn more:

https://openscholarship.wustl.edu/cgi/viewcontent.cgi?article=2155&context=law_lawreview

Lex talionis is the legal concept of…

Lex talionis is the legal concept of…

Answer: The law of retaliation

Visit this site to learn more:

Oxford Reference – Lex Talionis

The ® next to a brand name:

Answer: Indicates a Registered Trademark

Visit these sites to learn more:

https://www.uspto.gov/trademarks/basics/trademark-patent-copyright

https://www.uspto.gov/trademarks/basics/trademark-process

Which U.S. President also served as Chief Justice?

Answer: Howard Taft

Visit these sites to learn more:

https://constitutioncenter.org/blog/william-howard-tafts-truly-historic-double-double

Who was the U.S. President that nominated the most Justices to the U.S. Supreme court (excluding George Washington)?

Who was the U.S. President that nominated the most Justices to the U.S. Supreme court (excluding George Washington)?

Which of the following is the federal law which prohibits discrimination based upon age?

Which of the following is the federal law which prohibits discrimination based upon age?

Lex talionis is the legal concept of…

Lex talionis is the legal concept of…